|

According to a study by the National Bureau of Economic Research, "Graduating in a recession leads to large initial earnings losses." In other words, the surplus labor force allows employers to be more stingy on offering relatively competitive wages and benefits. In addition to wage stagnation/deflation, millennials are also saddled with tens of thousands of dollars in student loan debt. Millennials have taken longer to start families and buy their first home. This in part due to delaying these "gratifications" in exchange for investing their time and money into four to six years of college education. Here's a neat little infographic on millennials.

Millennials are less likely to be homeowners than other young adults of previous generations. Stricter lending rules, lower relative wages, and the inability to effectively save for a downpayment are some of the leading causes of "failure to mortgage" among millennials. Recent college graduates are spending at least 15% of their annual income (and in many cases more) in paying back their student loans. Many grads are paying what amounts to a mortgage payment just in student loans as well as their rent payment and general quality of life needs.

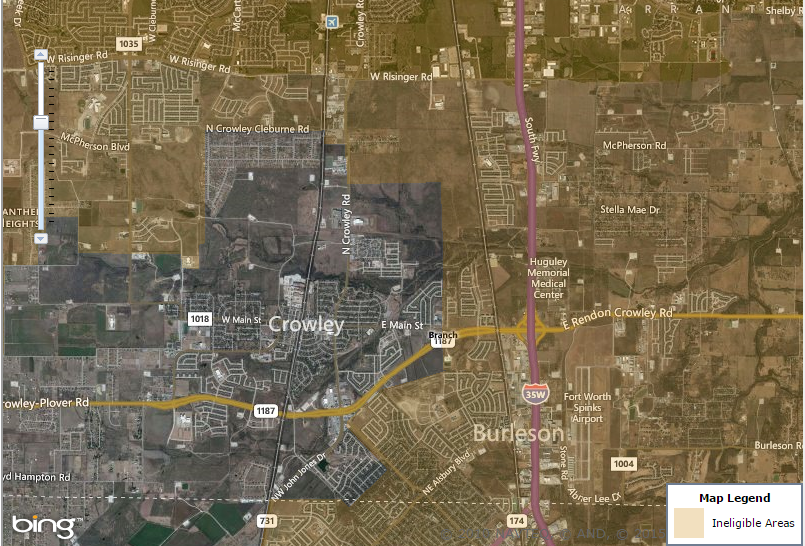

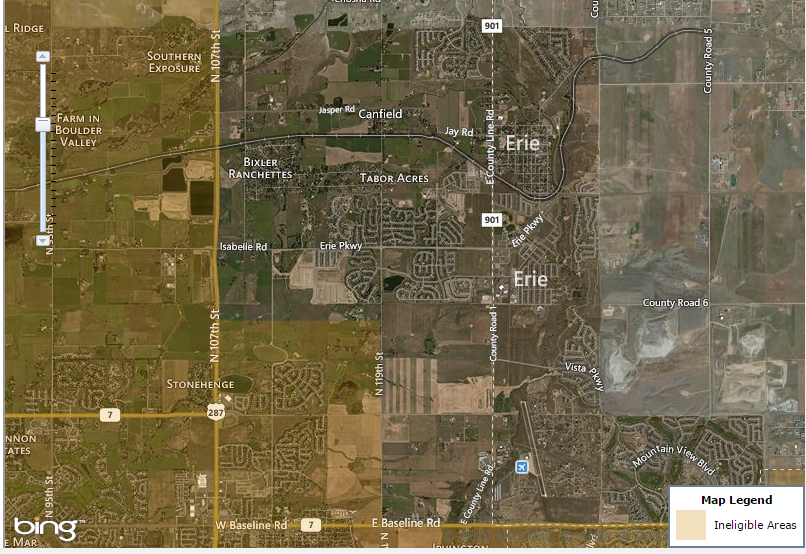

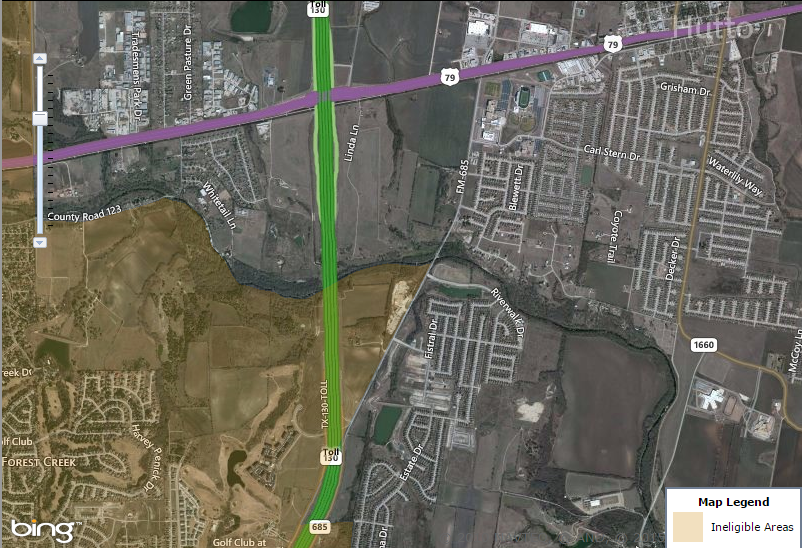

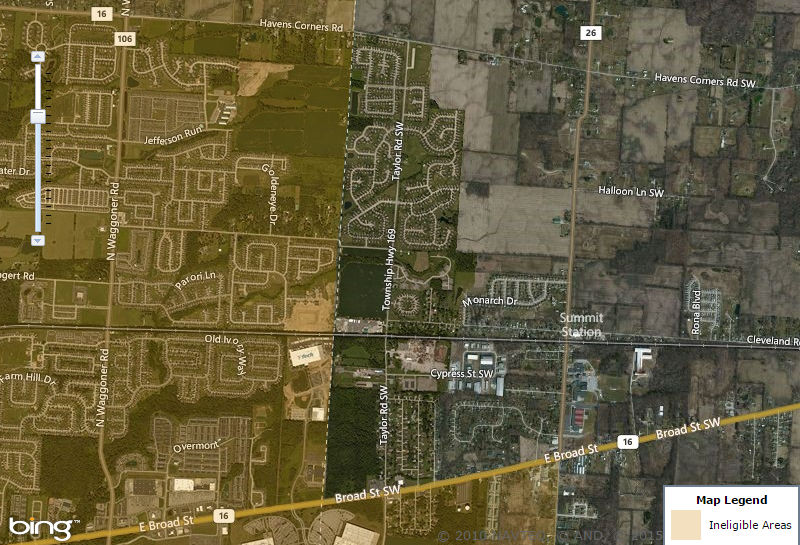

But millennials are buying homes. According to a recent generational trends report by the National Association of REALTORS®, millennials make up the largest share of home buyers at 32 percent. However, it is important to think about how millennials are financing these purchases. An FHA loan requires a 3.5% downpayment toward the purchase price. Here’s what it cost to buy a home. As noted earlier, many millennials are paying at least 15% of their income towards loans and their outstanding loan debt is factored into their affordability (lenders use the standard repayment plan regardless if IBR/ICR is being utilized). Unless they receive a gift from a family member (note that many millennials are first generation graduates), it is incredibly difficult for many millennials to save 3.5% of a $150,000 home ($5,200), not to mention the additional closing costs and other costs associated with making a deal. As a result, many millennials are taking advantage USDA Rural Development loans which do not require any downpayment. The only catch with using this loan program is that the property must be in a "rural" area which is defined as "open country that is not part of or associated with an urban area; or Any town, village, city, or place (including the immediately adjacent densely settled area) that is not part of or associated with an urban area, and that: Is rural in character with a population of less than 10,000; or Is not contained within a Metropolitan Statistical Area (MSA) and has a serious lack of mortgage credit with a population between 10,000 and 20,000." Tldr version, anywhere that isn't in the city limits of a major city or a densely populated exurb. The USDA loan program is a well-intended effort to support rural development and home ownership, however, it can be used by developers to incentivize leapfrog development. Many cities have areas on their periphery that have good access to transportation and are quickly being developed into fragmented subdivisions just a mile or so down the road from the city limits sign.

That's a great deal for millennial homebuyers trying to own their first piece of real estate, however it has many obvious impacts on rural character and sprawl. It creates service needs, education needs, and results in the loss of productive farmland and perpetuates the car-centric society in which we, as a generation, are trying to end. It is a clear example of the butterfly effect that the Great Recession has had on the millennial generation that came of age during the worst economic conditions since the Great Depression. They still want the American Dream; work hard, have a family, and have a nice home. Poor savings due to deflated wages and job outlook resulted in a domino effect in which many millennials are now living paycheck to paycheck in the sense that they are not saving. Student debt relief would go a long way in encouraging saving that can be used to give more choice to millennial homebuyers and allow them to buy that nice townhome or cape cod house close to the transit station and coffee shops. Until then, the student loan crisis will continue to be a ticking bomb that will eventually explode in the form of devastating losses in home values for the baby boomers that can't find buyers.

Are you a millennial homebuyer? We'd like to hear your financing stories... urban planning blog

|

|

RSS Feed

RSS Feed